Part 4 in the 7-part series, Open a Church Checking Account

Formally Organize Your Church

There are 2 approaches I’m aware of to formally organize your church:

- Unincorporated Association

- Corporation

- Remain legally under another church & use a fictitious business name for your church’s name

There are pros and cons to each. Remember, I’m no lawyer; if you’re looking for legal advice, now would be a good time to find a lawyer.

Whichever way you go, you’ll need to have a set of rules in place for how things are going to be run. For the first two legal structures above, those are called Bylaws. Denominational structures vary widely, so if you’re in that boat, ask up your chain of command. Bylaws generally don’t get filed with any government agency, but you have to have them.

All the churches I’ve supported have chosen to incorporate, so the following is based on those experiences.

Church Incorporation

Corporation requirements vary from state to state. Corporations are a non-person entity, a sort of ‘citizen’ of the state that has its own rights & responsibilities. It will even get its own social security number (Federal EIN)! In most cases, the paperwork is filed with your Secretary of State. In several states, this function has been delegated to a division called the Corporations Commission (MI & VA both do). In Louisiana (the only state built on the French legal tradition), the incorporation papers were approved by the state but the filed/registered with the the local Parish.

Search their website for forms, samples & fees. I usually call them as well to find out their processing times, whether we have to use “inc.” in the name, whether we can use our own form or have to use theirs, and what their submission options are (online, in person, fax).

A Unique Name

Your state will not allow you to incorporate with a name that is the same or “deceptively similar” to another existing corporation. For every state I’ve dealt with so far, there has been a searchable database on the state’s website. Planters use those to determine if the church has to append stuff to the name to make it unique.

In many cases, adding the specific city to the name is enough to make it unique. So, Destiny Church would not be the same as Destiny Church of Sheboygan. The State of CA recently rejected back to me several iterations like that; if in doubt, most states also offer a name reservation service so you can know in advance if they’ll take your name.

What to File

You will need to submit some or all of the following in your Articles of Incorporation (in descending order of commonality between states):

- Unique legal name

- Name of the incorporator(s)

- Physical address of corporation

- Name & address of your Registered Agent (aka Agent for Service of Process, Statutory Agent)

- Purpose clause that satisfies IRS requirements

- Dissolution clause that satisfies IRS requirements

- Additional provisions that set you up for IRS 501c3 nonprofit status

- Names & addresses of initial Directors

- Whether or not church members will have voting power

- Mailing address of corporation

In some states (GA & AZ at least), you have to publish the incorporation in a local paper, usually within 24-48 hours. Heads up!

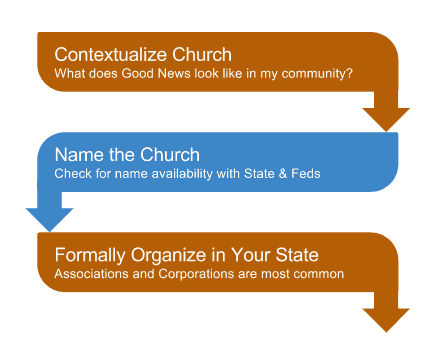

Steps to Open Church Checking Account

hyperlinks will be added as new posts go live

- Contextualize Your Church

- Name Your Church Plant

- Formally Organize Your Church

- Register with the Feds

- Hold a Board Meeting

- Now Go the the Bank

Leave a Reply